Philippine Tax Table 2024 Calculator. Looking for a payroll solution that’s automatically updated with the latest government mandates? Avoid underpaying or overpaying your taxes and save.

Easily determine accurate withholding tax amounts for salaries, services, and other income types. In the realm of philippine taxation, withholding tax stands as a pivotal mechanism, ensuring a seamless flow of revenue to the government.

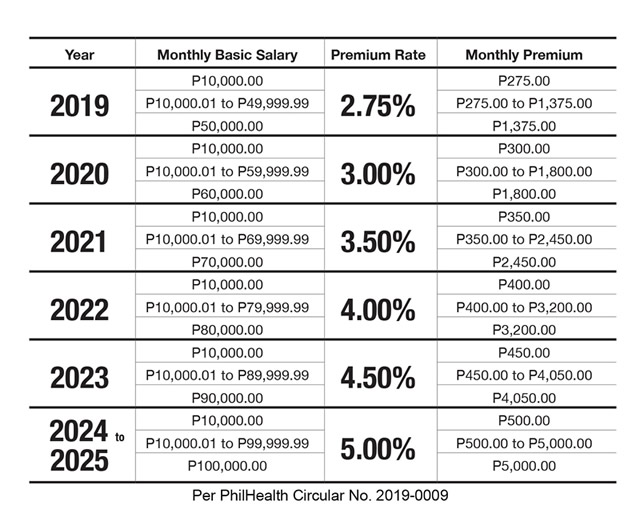

Tax, SSS, and PHIC Updates for 2023 InCorp Philippines, Philippines annual bonus tax calculator 2024, use icalculator™ ph to instantly calculate your salary increase in 2024 with the latest philippines tax tables.

Tax Rate 2024 Philippines Calculator Nessa Zulema, Are you struggling to compute taxes for your employees?

Philippine Tax Calculator 2024 Eden Anallise, It outlines how much tax individuals and corporations must pay depending on their annual.

Philippine Tax Calculator 2024 Roana Neilla, Just enter your gross income and the tool quickly calculates your net pay after taxes and deductions.

2024 Tax Calculator Philippines Calculator Adan Lissie, As a resident of the philippines earning an annual income of ₱100,000, you will be subject to a tax liability amounting to ₱6,398.

Latest BIR Tax Rates 2023 Philippines Life Guide PH, The department of finance (dof) has created the tax calculator to help the filipinos in computing their income taxes once the 2017 proposed tax reform be approved.

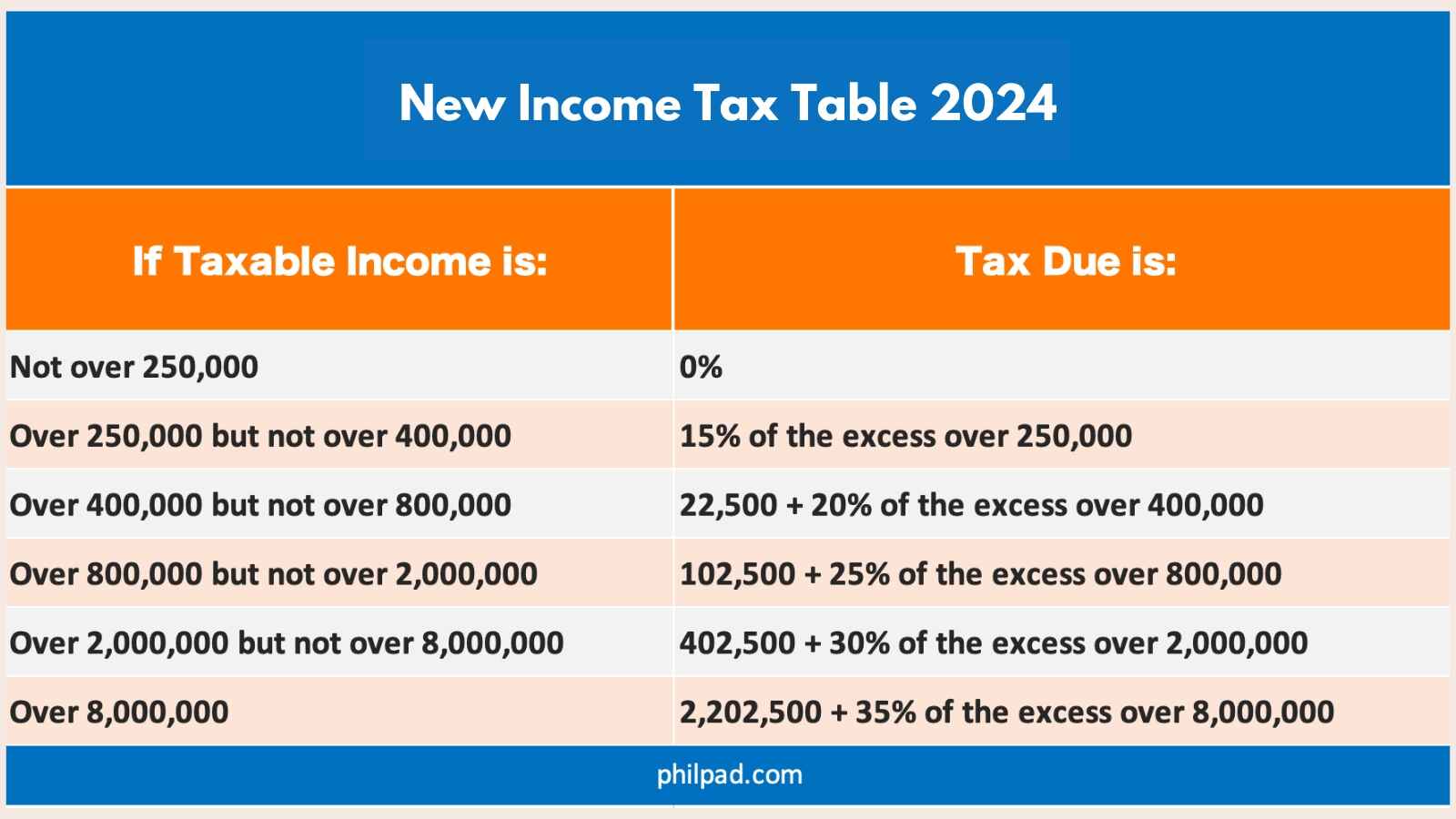

Philippine Tax Calculator 2024 Star Zahara, The bir income tax table is a helpful tool for filipino taxpayers to use when calculating their taxes due.

2023 Tax Rates & Federal Tax Brackets Top Dollar, The bir income tax table is a helpful tool for filipino taxpayers to use when calculating their taxes due.